An increase in retained earnings could be a sign of increased dividends in the future; in addition, the increase in cash of 19% could support this conclusion. Common-size analysis enables us to compare companies on equal ground, and as this analysis shows, Coca-Cola is outperforming PepsiCo in terms of income statement information. However, as you will learn in this chapter, there are many other measures to consider before concluding that Coca-Cola is winning the financial performance battle. The steps mentioned above are used to prepare the common size income statement of any business. However, it may bcome a complex process, depending on the size and nature of business operations.

Common Size Financial Statements in Detail

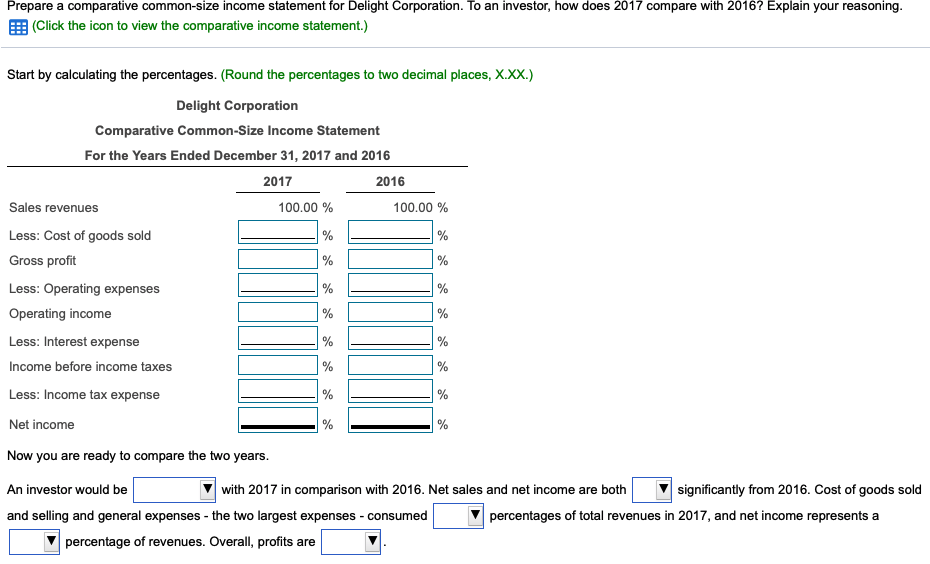

It standardizes financial data, making it easier to compare with other periods or companies, irrespective of their size. By showing each item as a percentage of revenue, it highlights changes in cost structure and profitability over time. Divide each line item by total revenue and multiply by 100 to express it as a percentage of total revenue. Most comparative common size income statement accounting computer programs, including QuickBooks, Peachtree, and MAS 90, provide common-size analysis reports. You simply select the appropriate report format and financial statement date, and the system prints the report. Thus accountants using this type of software can focus more on analyzing common-size information than on preparing it.

How They Complement Each Other in Financial Analysis

Likewise, any single liability is compared to the value of total liabilities, and any equity account is compared to the value of total equity. For this reason, each major classification of account will equal 100%, as all smaller components will add up to the major account classification. A horizontal common-size income statement is a financial statement that compares the percentage change of each item from one period to another. It helps identify the relative importance of different income statement items and highlights company performance changes over time. The balance sheet provides a snapshot overview of the firm’s assets, liabilities, and shareholders’ equity for the reporting period.

Focus and Presentation of Data

Common size analysis displays each line item of your financial statement as a percentage of a base figure to help you determine how your company is performing year over year, and compared to competitors. It also shows the impact of each line item on the overall revenue, cash flow or asset figures for your company. It makes analysis much easier such that the analyst can see what is actually driving the profit of a company and then compare that performance to its peers. It allows an analyst to look at how the performance has changed over the period. From an investor’s perspective, a common size income statement helps spot patterns in the company’s performance that a basic income statement may not uncover. The common size income statement, is the profit and loss statement of the company where each line item is shown as a percentage of the total sales.

It reveals the relative proportion of expenses and profitability, helping identify areas of strength and weakness. Note that rounding issues sometimes cause subtotals in the percent column to be off by a small amount. The goodwill level on a balance sheet also helps indicate the extent to which a company has relied on acquisitions for growth. Her debt does not keep her from living her life, but it does limit her choices, which in turn restricts her decisions and future possibilities.

Format of Common-size Income Statement (Statement of Profit & Loss)

Both tools aim to provide insights into a company’s financial performance and structure, aiding stakeholders in making informed decisions. Financial statements are critical tools for communicating a company’s financial status to various stakeholders, such as owners, investors, creditors, and banks. These statements not only reveal the financial health of a company but also allow for comparisons with past performances and industry competitors. By showing costs as a percentage of revenue, it helps identify areas where expenses can be reduced. Common-size Statements are accounting statements expressed in percentage of some base rather than rupees. Now that you have covered the basic financial statements and a little bit about how they are used, where do we find them?

- This makes it easier to compare figures from one period to the next, compare departments within an organization, and compare the firm to other companies of any size as well as industry averages.

- Charlie is a much bigger retailer for outdoor gear, as Charlie has nearly seven times greater sales than Clear Lake.

- Comparative statement of profit and loss is the statement’s horizontal analysis of profit and loss.

Overall, her net income, or personal profit, what she clears after covering her living expenses, has almost doubled. Horizontal analysis is called horizontal because we look at one account at a time across time. We can perform this type of analysis on the balance sheet or the income statement. For instance, we can see that the gross profit margin and operating income margin have been quite stable over the last three financial years. However, the net income has witnessed a slight improvement during the same period. An analyst can further deep dive to determine the reason behind the same to make a more meaningful insight.

It gives valuable insight into the financial health and structure of the business relative to the sales made so that they can take decisions related to expense management, production techniques etc. It facilitates trend analysis and comparison of the financial statement over a period of time. Common-size income statement analysis states every line item on the income statement as a percentage of sales. If you have more than one year of financial data, you can compare income statements to see your financial progress. This type of analysis will let you see how revenues and spending on different types of expenses change from one year to the next.

Using Clear Lake Sporting Goods’ current balance sheet, we can see how each line item in its statement is divided by total assets in order to assemble a common-size balance sheet (see Figure 5.22). A common-size analysis is unlikely to provide a comprehensive and clear conclusion on a company on its own. A short-term drop in profitability could indicate just a speed bump rather than a permanent loss in profit margins. A common-size balance sheet is a comparative analysis of a company’s performance over a time period. You can see that long-term debt averages around 34% of total assets over the two-year period, which is reasonable. Cash ranges between 5% and 8.5% of total assets and short-term debt accounts for about 5% of total assets over the two years.

The cost of goods sold dropped, while both selling and administrative expenses and depreciation rose. The firm may have bought new fixed assets and/or sales commissions may have increased due to hiring new sales personnel. Again, rent is the biggest discretionary use of cash for living expenses, but debts demand the most significant portion of cash flows. Repayments and interest together are 30 percent of Alice’s cash—as much as she pays for rent and food.

Notice that PepsiCo has the highest net sales at $57,838,000,000 versus Coca-Cola at $35,119,000,000. Once converted to common-size percentages, however, we see that Coca-Cola outperforms PepsiCo in virtually every income statement category. Coca-Cola’s cost of goods sold is 36.1 percent of net sales compared to 45.9 percent at PepsiCo. Coca-Cola’s gross margin is 63.9 percent of net sales compared to 54.1 percent at PepsiCo. Coca-Cola’s operating income is 24.1 percent of sales compared to 14.4 percent at PepsiCo. Figure 13.8 compares common-size gross margin and operating income for Coca-Cola and PepsiCo.