For example, if a company pays $12,000 for an annual insurance coverage, their monthly prepaid insurance expense is $1,000 ($12,000/12 months). This method guarantees that expenses are accurately allocated during the prepaid period, reflecting the steady utilization of insurance coverage. Prepaid insurance is nearly always classified as a current asset on the balance sheet, since the term of the related insurance contract that has been prepaid is usually for a period of one year or less.

Table of Contents

Company ABC will initially book the full $120,000 as a debit to prepaid insurance, an asset on the balance sheet, and a credit to cash. To illustrate prepaid insurance, let’s assume that on November 20 a company pays an insurance premium of $2,400 for insurance protection during the six-month period of December 1 through May 31. On November 20, the payment is entered with a debit of $2,400 to Prepaid Insurance and a credit of $2,400 to Cash.

How long is prepaid insurance considered a current asset?

Prepaid insurance is usually considered a current asset, as it becomes converted to cash or used within a fairly short time. But if a prepaid expense is not consumed within the year after payment, it becomes a long-term asset, which is not a very common occurrence. The payment of the insurance expense is similar to money in the bank—as that money is used up, it is withdrawn from the account in each month or accounting period. Prepaid insurance for businesses is very valuable in terms of providing financial stability, budgeting accuracy, and risk mitigation. However, to ensure accuracy of financial statements, it is essential that these are recorded in the correct accounting period. By leveraging HighRadius’ Record to Report (R2R) suite organizations can automate prepaid insurance journal entry management, reducing manual errors and enhancing efficiency.

- This payment represents a prepaid expense, but its classification as an asset might surprise you.

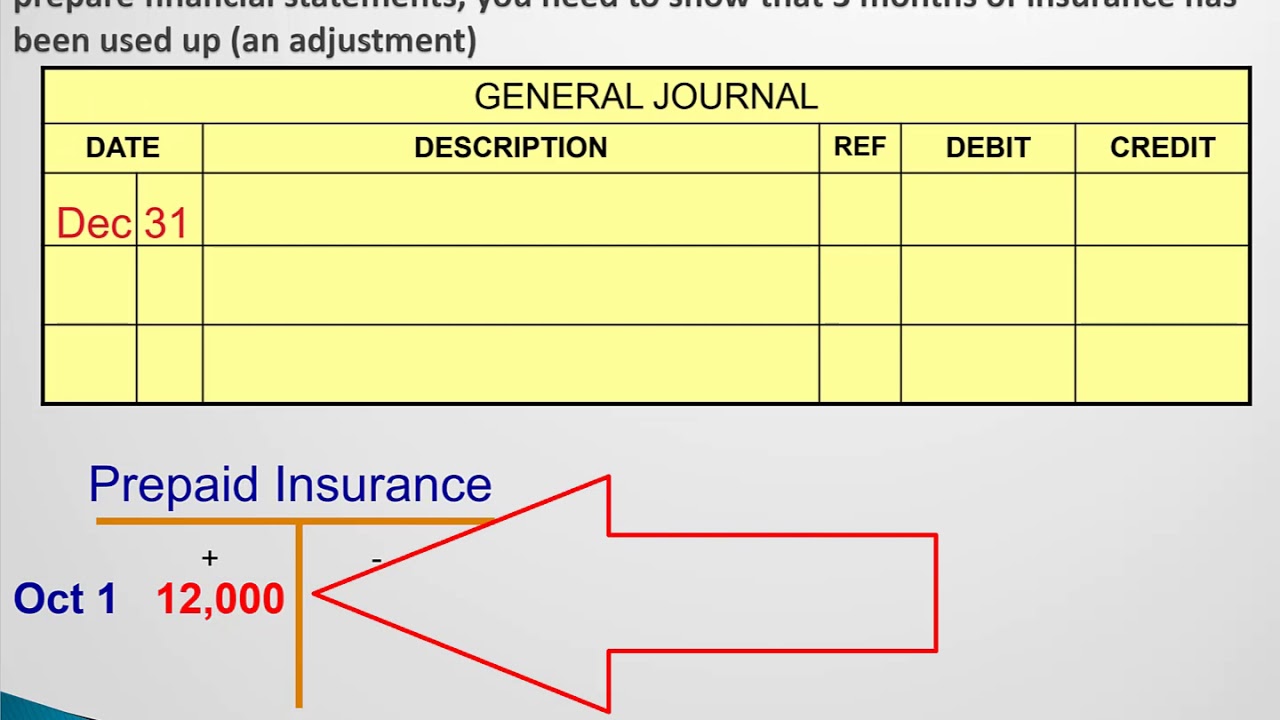

- As time passes, the debit balance decreases as adjusting entries credit the account Prepaid Insurance and debit Insurance Expense.

- The amount that has not yet expired should be the balance in Prepaid Insurance.

When You Should (and Shouldn’t) Outsource Your Accounting Services

The question of how long prepaid insurance remains a current asset can feel like a grey area, but accounting principles offer some clear guidelines. Unless an insurance claim is filed, prepaid insurance is usually renewable by the policyholder shortly before the expiry date on the same terms and conditions as the original insurance contract. However, the premiums may be marginally higher to account for inflation and other operating factors.

The company should not record the advance payment as the insurance expense immediately. This is due to, under the accrual basis of accounting, the expense should only be recorded when it occurs. Prepaid expense is an accounting line item on a company’s balance sheet that refers to goods and services that have been paid for but not yet incurred. Recording prepaid expenses must be done correctly and according to accounting standards. They are first recorded as an asset and then, over time, expensed onto the income statement. For example, assume Company ABC purchases insurance for the upcoming 12-month period.

An insurance premium is an amount that an organization pays on behalf of its employees and the policies that a business has rendered. The expense, unexpired and prepaid, is reported in the books of accounts under current assets. Each month, the business’s accounting department would make an adjusting journal entry of $1,000, representing the amount of one month’s premium payment in the general ledger. It would be entered as a credit in the asset account and as a debit to the insurance expense account. When a company pays its insurance payments in advance, it makes a debit entry to its prepaid insurance asset account.

The current ratio is a useful liquidity metric to evaluate whether a company can meet its short-term obligations by utilizing assets which can quickly be converted into cash. The current ratio is calculated by dividing current assets by current liabilities. By definition, current prepaid assets would be included in the numerator, or current assets portion of the current ratio, and positively affect the results. Typically an entity will pay its insurance is prepaid insurance a contra asset premiums at the beginning of the policy period, recognizing a prepaid asset subsequently amortized over the term of the policy. Therefore under the accrual accounting model an entity only recognizes an expense on the income statement once the good or service purchased has been delivered or used. Prior to consumption of the good or service, the entity has an asset because they exchanged cash for the right to a good or service at some time in the future.

Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.